What is a Good Monthly Churn Rate? Industry Benchmarks

Your churn rate is the heartbeat of your subscription business – ignore it, and you might find yourself flatlining before you scale.

For SaaS companies, churn isn’t just a number. It’s a reflection of your product’s value, your ability to retain customers, and, ultimately, your long-term viability.

A high churn rate means your growth is built on a crumbling foundation – you’re acquiring customers only to watch them slip away just as fast. And if you’re churning faster than you’re growing? That’s the beginning of the end.

Churn is inevitable.

But controlling it? That’s where the real game is played.

So, what’s considered a “good” churn rate? Here’s the short answer: it depends.

Benchmarks vary. B2C SaaS businesses often see monthly churn rates in the 3-7% range. Enterprise B2B SaaS? Less than 2% is the gold standard. Anything above 5% is a serious red flag. But these numbers alone don’t tell the full story. A high churn rate might not be a death sentence if your customer acquisition cost (CAC) is low and your lifetime value (LTV) is high. On the other hand, even a “good” churn rate can kill a company if it outpaces revenue growth.

Here’s the real question: Are you keeping the right customers, and are they sticking around long enough to make your growth sustainable?

Most discussions on churn stop at the benchmarks. But numbers alone won’t fix your retention problem. This article goes further – we’ll break down what churn means for your business, what drives it, and, most importantly, how you can fix it.

Because churn isn’t just something to be minimized. Handled correctly, it can be an early warning system – a sign of pricing misalignment, weak onboarding, or a product-market fit issue you need to solve. Sometimes, a bit of churn can even be a good thing (yes, really).

So, let’s get into it. What is a good monthly churn rate? More importantly, how do you ensure yours is under control?

What is a Monthly Churn Rate?

Churn. The word alone makes SaaS founders uncomfortable. And for good reason – churn determines whether you’re building a sustainable, scalable business or just pouring water into a leaky bucket.

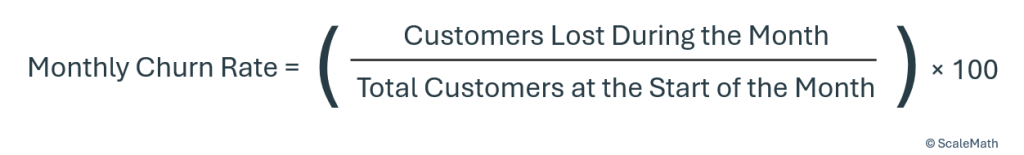

At its core, the monthly churn rate measures the percentage of customers who cancel their subscriptions in a given month.

It’s calculated using a simple formula:

Example: You start the month with 1,000 customers. By the end of the month, 50 have left.

5% churn. Not catastrophic, but certainly not ideal.

Why Monthly vs. Annual Matters

Some businesses track churn on an annual basis. But waiting 12 months to realize you have a churn problem? That’s like noticing the fire alarm after the building has burned down.

For SaaS companies, monthly churn provides a real-time pulse check on retention. It allows for:

- Faster iteration – You can spot and fix issues before they spiral.

- Granular insights – Trends become clearer when examined in shorter timeframes.

- More accurate forecasting – Understanding churn at a monthly level helps with revenue modeling and growth planning.

Annual churn can be misleading – if you lose 5% of customers every month, your annual churn isn’t 5%. Thanks to compounding losses, it’s closer to 46%.

Not All Churn is Created Equal

Churn isn’t just about how many customers leave. It’s about who is leaving and why.

- Voluntary Churn – Customers cancel because they’re unhappy, have found a better alternative, or no longer need the service. They made an active decision to leave.

- Involuntary Churn – Customers are lost due to payment failures, such as expired credit cards, declined transactions, or billing errors. These aren’t customers who want to leave, but they will unless you have a system in place to recover failed payments.

- Revenue Churn – A customer may still be subscribed but paying you less. Downgrades, discounts, and plan reductions all impact revenue churn. A SaaS company could have a stable customer count but still be bleeding revenue.

Losing one enterprise customer who pays $1,000/month is a bigger hit than losing five users on a $20 plan. That’s why tracking revenue churn alongside customer churn is critical – it helps distinguish between a pricing problem, a product issue, or a simple case of targeting the wrong customer segment.

The Big Picture

Understanding churn isn’t just about hitting some industry benchmark – it’s about knowing whether your business is built for long-term growth. A SaaS company that manages to keep churn under 2% monthly will scale predictably. Anything higher? Time to dig into the numbers and find out why.

What is Considered a “Good” Monthly Churn Rate?

Understanding what constitutes a “good” monthly churn rate is essential for SaaS businesses aiming for sustainable growth. While benchmarks vary across industries and company sizes, they are useful reference points for gauging a company’s performance.

Industry Benchmarks

- B2B SaaS:

- SMB-focused: Monthly churn rates typically range between 3% and 5%.

- Enterprise-focused: These companies often experience lower churn, with monthly rates around 1% to 2%.

- B2C SaaS:

- Due to lower switching costs, B2C SaaS companies often see higher churn rates, averaging between 3% and 7% monthly.

- Subscription eCommerce:

- Monthly churn rates for subscription-based eCommerce businesses typically fall between 5% and 10%.

- Media & Streaming Services:

- These services often experience monthly churn rates ranging from 6% to 8%.

- Financial Services:

- The financial sector sees an average annual churn rate of approximately 19%.

“Acceptable” vs. “Ideal” Churn Rates

- Exceptional: A monthly churn rate below 1.5% is considered outstanding, particularly for B2B SaaS companies targeting large enterprises.

- Manageable: Rates between 3% and 5% are acceptable but indicate room for improvement.

- Concerning: A churn rate exceeding 7% is a red flag and warrants immediate attention.

Calculating Net Churn: Logo Churn vs. Revenue Churn

It’s essential to distinguish between logo churn (the percentage of customers lost) and revenue churn (the percentage of revenue lost due to churn).

A company might lose 5% of its customers monthly but offset that loss by upselling existing customers, resulting in minimal revenue impact. Conversely, losing a few high-value clients can significantly affect revenue, even if logo churn remains low.

Beyond Churn: The Bigger Picture

Focusing solely on churn rates can be misleading. Considering the broader growth equation, particularly the Customer Lifetime Value (CLV) to Customer Acquisition Cost (CAC) ratio is crucial. This metric assesses the value a customer brings over their lifetime relative to the cost of acquiring them.

- Ideal Ratio: An LTV:CAC ratio of 3:1 is generally considered healthy, indicating that the value derived from a customer is three times the cost of acquiring them.

- Implications of the Ratio:

- Less than 1:1: You’re spending more to acquire customers than they’re worth, leading to financial losses.

- Around 1:1: Acquisition costs are equal to customer value, suggesting a need for improved efficiency.

- Greater than 3:1: While this indicates efficient acquisition, it may also suggest underinvestment in growth opportunities.

By analyzing both churn rates and the LTV:CAC ratio, SaaS businesses can gain a comprehensive understanding of their customer dynamics and financial health, enabling more informed strategic decisions.

The Real Cost of Churn (Why It’s More Than Just a Number)

Churn is the silent killer of SaaS businesses, lurking beneath the surface, eroding your customer base and revenue. While losing a few customers monthly might seem manageable, the compounding effect can be devastating over time.

The Compounding Effect of Churn

Imagine you’re losing 5% of your customers every month. At first glance, that doesn’t sound too alarming.

However, due to the compounding nature of churn, this translates to approximately a 46% loss over a year.

In other words, nearly half of your customer base could vanish if this trend continues unchecked.

Impact on CAC Payback Period

Customer Acquisition Cost (CAC) is your investment to bring a new customer on board. Ideally, you recoup this cost over time as the customer continues to pay for your service. But what happens if customers churn before you’ve recovered their acquisition cost?

Let’s say your CAC payback period is 12 months, meaning it takes a year to break even on the investment made to acquire a customer. If customers leave after just six months, you’re losing future revenue and failing to recoup your initial investment. This scenario strains cash flow and can jeopardize the sustainability of your business.

Churn’s Impact on Investor Perception

Investors are keenly aware of churn rates. High churn signals weak customer retention, suggesting that your product may not meet market needs or that competitors are luring your customers away. This perception can lead to reduced valuations and make it more challenging to secure funding. After all, why would investors pour money into a leaky bucket?

The Silver Lining: Reducing Churn

The good news? Even a modest reduction in churn can have a significant impact.

Consider a SaaS company generating $100,000 in monthly recurring revenue with a 5% monthly churn rate. By reducing churn to 4%, they retain an additional $1,000 in revenue that would have otherwise been lost. Over a year, this adds up to $12,000 – funds that can be reinvested into growth initiatives.

In essence, while acquiring new customers is vital, retaining existing ones is equally, if not more, important.

Focusing on reducing churn not only stabilizes revenue, but also enhances your company’s appeal to investors and sets the stage for sustainable growth.

Diagnosing Churn: What’s Causing It?

Understanding the root causes of churn is essential for any SaaS business aiming to foster long-term customer relationships. Let’s identify the primary culprits behind customer attrition – and explore actionable solutions.

1. Poor Customer Onboarding

First impressions matter. If users don’t swiftly experience their first “aha” moment, they may question the value of your product and consider leaving.

Solution: Enhance your onboarding process with interactive tutorials, timely emails, and clear success milestones. For instance, a recent SaaS case study identified how one SaaS startup facing an 8% churn rate revamped its onboarding, improving customer retention.

2. Weak Product-Market Fit

Despite strong acquisition efforts, high churn often points to a misalignment between your product and market needs.

- Consistent High Churn: If users frequently leave after initial engagement, your product may not meet their expectations.

- Frequent Downgrades: Regular downgrades suggest issues with pricing or perceived value.

Solution: Conduct in-depth interviews with former customers to uncover sources of dissatisfaction and refine your offerings accordingly.

3. Lack of Engagement & Customer Success

The best predictor of churn is dwindling product usage. Engaged customers are less likely to leave.

Solution:

- Proactive Outreach: Monitor engagement metrics and reach out when usage drops.

- NPS Surveys: Use Net Promoter Score surveys to identify at-risk customers and address their concerns promptly.

4. Involuntary Churn (Payment Failures)

A significant portion of churn is involuntary, often due to payment issues. Implementing effective strategies can mitigate this.

Solution: Adopt smart dunning processes, such as automatic payment retries and timely email alerts, to recover failed payments and retain customers.

In essence, diagnosing churn requires a multifaceted approach. SaaS businesses can significantly enhance customer retention by addressing onboarding, ensuring product-market fit, fostering engagement, and mitigating involuntary losses.

Strategies to Reduce Churn (Actionable Steps for SaaS Businesses)

Reducing churn is paramount for SaaS companies aiming for sustainable growth. While acquiring new customers is essential, retaining existing ones is often more cost-effective and beneficial in the long run. Here are five actionable strategies to help minimize churn:

1. Enhance Onboarding & First-Use Experience

First impressions matter. A seamless onboarding process ensures that new users quickly realize the value of your product, reducing the likelihood of early churn.

- Reduce Time-to-Value (TTV): Streamline the onboarding process so users can achieve their first success swiftly. This might involve simplifying sign-up procedures or providing immediate access to core features.

- Implement Guided Product Tours: Interactive tutorials and in-app guidance can help users navigate your platform effectively, ensuring they understand and use key features.

2. Customer Success & Retention Marketing

Proactive engagement with customers can preempt potential churn triggers.

- Segment High-Risk Customers: Identify users who show signs of disengagement or dissatisfaction and assign customer success managers to address their concerns.

- Win-Back Campaigns: Develop targeted marketing efforts to re-engage churned customers, offering incentives or highlighting new features that may attract them back.

3. Optimize Pricing & Annual Plans

Flexible and value-driven pricing can enhance customer retention.

- Offer Discounted Annual Plans: Provide discounts on annual subscriptions to encourage long-term commitments and improve cash flow predictability.

- Test Value-Based Pricing: Align your pricing with the perceived value by charging based on usage or specific features, ensuring customers feel they are getting their money’s worth.

4. Reduce Involuntary Churn

Payment failures can inadvertently lead to customer loss.

- Implement Dunning Tools: Use platforms such as Stripe, Chargebee, or Recurly to automate payment retries and send reminders to customers about updating their payment information.

5. Monitor & Predict Churn with Data

Data-driven insights can help anticipate and mitigate churn.

- Predictive Churn Models: Analyze user behavior to identify patterns that precede churn, allowing for timely interventions.

- Track Feature Adoption Rates: Monitor which features are underused; lack of engagement with key functionalities can lead to churn.

Manual interventions, while effective, may not be scalable as your customer base grows. Using specialized SaaS tools can automate and enhance your churn reduction efforts:

- ChurnZero: Provides real-time customer health scores and automated playbooks to engage at-risk customers.

- Paddle: Focuses on reducing involuntary churn by optimizing billing processes and recovering failed payments.

By integrating these strategies and tools, SaaS businesses can proactively address churn, ensuring a loyal customer base and sustained growth.

Conclusion

Churn isn’t just a metric; it’s a mirror reflecting your product’s market alignment, customer satisfaction, and growth efficiency. Addressing churn requires a deep dive into its root causes and a commitment to continuous improvement.

Next Steps:

- Conduct a Churn Audit: Analyze your churn data to identify patterns and underlying causes. Are customers leaving due to onboarding issues, lack of engagement, or unmet expectations? Understanding the ‘why’ is the first step toward effective intervention.

- Implement Retention Experiments: Based on your findings, design targeted strategies to reduce churn. This could involve refining your onboarding process, enhancing customer support, or adjusting pricing models. Aim to test 1-2 strategies per quarter, allowing sufficient time to measure impact and iterate as needed.

At ScaleMath, we specialize in helping SaaS businesses like yours tackle challenges like this. Our team of experts is ready to assist you in auditing your churn factors and implementing effective retention strategies.

👋 Looking for input from a team that’s worked with category-leading companies – possibly like yours? We’re here and always happy to help! Use the contact widget in the bottom right-hand corner to get in touch or apply to work with us here.