What is Net Revenue Retention & How to Calculate It

Growing fast is great, but growing sustainably is even better. And a cornerstone of sustainable growth is being able to retain and grow revenue from your existing customer base.

To achieve this, monthly recurring revenue (MRR) alone is not a great KPI.

So, here’s why you should already be using net revenue retention, or start when it makes sense (more on that later!) as the new benchmark for your SaaS business.

What is NRR (Net Revenue Retention)?

Net revenue retention is a revenue metric that measures the recurring revenue generated from existing customers over a set period of time.

It is often also referred to as net dollar retention (NDR).

Net revenue retention includes upgrades, downgrades, and customer churn to indicate business growth potential from the current customer base.

Net revenue retention does not include new customers.

Yes, excluding new customers might be somewhat unconventional, especially if NRR is new to you. However, there are good reasons (and proof) to back up why NRR matters…

Why is Net Revenue Retention Important to Recurring Revenue Businesses?

NRR is a crucial metric for subscription companies looking to assess the sustainability of their business. Sustainable growth in SaaS relies on retaining existing customers and growing their accounts with you. MRR is obviously not a sufficient metric for this.

Measures more than just growth.

New founders love to chase growth at all costs, but this metric actually tells you a lot more about a company than looking at high-level metrics such as MRR.

Why? Well, put it this way.

A low NRR would indicate that a company is:

- Struggling to retain customers

- Doesn’t have a sticky product

- Lacks customer engagement

MRR can hide this when growth is used as sticky tape to fix a leaky bucket, but you’ll never achieve truly sustainable growth with this approach.

Before we wrap up this section, let’s finish off with a friendly reminder:

Growth at all costs was never a good mindset to begin with.

NRR Rates of SaaS Companies With The Most Successful IPOs

Although going public might not be a goal you’re even working towards for your company, it’s still worth taking a look at the NRR rates of some of the most successful IPOs in SaaS:

Snowflake (SNOW):

Snowflake’s NRR rate of approximately 158% at the time of its IPO was reported in various financial analyses and IPO-related documentation. For instance, Snowflake’s S-1 filing with the SEC highlighted its impressive growth metrics. Sources such as CNBC and Bloomberg also covered these figures in their IPO reporting (source).

Zoom Video Communications (ZM):

Zoom’s NRR rate of around 130% to 140% around its IPO was discussed in the company’s S-1 filing and subsequent earnings reports. Financial news outlets like The Wall Street Journal and Reuters reported these figures (source).

DocuSign (DOCU):

DocuSign’s NRR rate above 120% was reported in its S-1 filing and in earnings reports following its IPO. Financial analysis from sources such as MarketWatch and TechCrunch also covered this metric (source).

HubSpot (HUBS):

HubSpot’s NRR rate in the range of 100% to 120% was detailed in its S-1 filing and reflected in financial reports and analyses from sources like TechCrunch and The Financial Times (source).

ServiceNow (NOW):

ServiceNow’s NRR rate was mentioned in its earlier financial disclosures and IPO filings. Coverage from sources like CNBC and The Wall Street Journal often highlighted this metric (source).

How to Calculate Net Revenue Retention

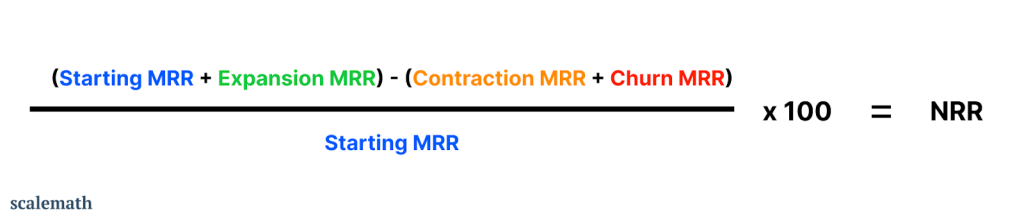

The net revenue retention formula is simple:

- Add up your Starting MRR and Expansion MRR

- Add up your Contraction MRR and Churn MRR

- Subtract #2 from #1.

- Divide by your Starting MRR

- Multiply by 100

- Your result is your net revenue retention rate.

Starting MRR: The monthly recurring revenue from the previous month.

Expansion MRR: The total new revenue that was generated from existing customers (through upgrades, upsells, etc.).

Contraction MRR: The total revenue lost from existing customers from downgrades.

Churn MRR: The total revenue lost from customers churning.

What is a Good Net Revenue Retention Rate?

Now that you know how to calculate your NRR, and have likely just plugged in the figures for your business into the above formula, it’s safe to assume you’ll be wondering whether you have a good net revenue retention rate.

The simple answer is that as long as you’re above 100%, you’re in a good position. Some industry benchmarks say that a good position is 109%.

Obviously, the higher, the better. So you want to set realistic goals, but also reach goals that encourage you and your team to frequently question why your NRR is what it is, and whether you can do anything to raise it even further.

And I would add two additional rules of thumb that you may find useful:

- An NRR rate of above 120% is indicative of a very healthy business.

- For anyone under 100%, you should focus on why customers are churning (and/or contracting) rather than going all in on finding new customers, as this is ultimately meaningless. Once you tap out on growth, if you still have an NRR of under 100%, you’ll end up in a bad position – don’t put this off chasing the next hype marketing strategy that can bring in quick revenue.

Net Revenue Retention vs Gross Revenue Retention

Gross revenue retention measures the total revenue retained from existing customers over a given period, excluding any increases (expansion revenue) or decreases (contraction revenue) in revenue.

It is a simplified version of NRR that uses this formula:

(Total revenue – churn) / Total revenue

As a result, GRR can’t exceed 100% because it doesn’t consider the revenue growth driven by existing customers/users of your product.

We almost always gain more from focusing on NRR and investigating what makes a company’s NRR a certain value. This is simply because GRR mainly helps you understand income retention – but there are other KPIs that indicate this.

Net Revenue Retention Benchmarks

NRR benchmarks compare companies’ performance to provide a clearer indication of how a company is doing relative to its peers. As might be imagined, these benchmarks vary wildly depending on the industry, and comparing net revenue retention for a SaaS company with a business from an entirely different industry makes little sense.

According to SaaS Capital’s 2023 Retention Benchmarks report, the median NRR across SaaS companies is 102%, with higher ACVs (annual contract value) generally correlating with better retention rates.

For example, SaaS companies with ACVs above $250,000 tended to see media NRR rates of around 110%, whilst companies with ACVs lower than $12,000 saw NRR rates closer to 100%.

What this data highlights is the importance of targeting higher-value clients, as they tend to yield higher NRR as a result of increased stickiness and upsell potential.

Overall, these benchmarks show that achieving an NRR over 120% indicates an extremely healthy business, with strong growth, and a competitive edge.

Net Revenue (NRR) Frequently Asked Questions

What is NRR in SaaS?

Net revenue retention is a revenue metric that measures the recurring revenue generated from existing customers over a set period of time.

Here’s how to calculate it:

- Add up your Starting MRR and Expansion MRR

- Add up your Contraction MRR and Churn MRR

- Subtract #2 from #1.

- Divide by your Starting MRR

- Multiply by 100

- Your result is your net revenue retention rate.

What is the average net revenue retention for SaaS companies?

The median net revenue retention (NRR) rate across all SaaS companies was 102%. Anything under 80% is generally considered low.

Note: The NRR that your business can achieve heavily depends on the business model, target market, and a whole range of other factors. So what may be seen as bad for one business might be good for another.

What is the difference between NRR and MRR?

Monthly recurring revenue (MRR) is simply the total of all active subscriptions for a particular month. Net revenue retention (NRR) is a revenue metric that measures overall business health using growth from existing customers alone (as well as churn).

👋 Looking for input from a team that’s worked with category-leading companies – possibly like yours? We’re here and always happy to help! Use the contact widget in the bottom right-hand corner to get in touch or apply to work with us here.